Emerging Real Estate Hotspots: Unveiling the Next Global Investment Destinations

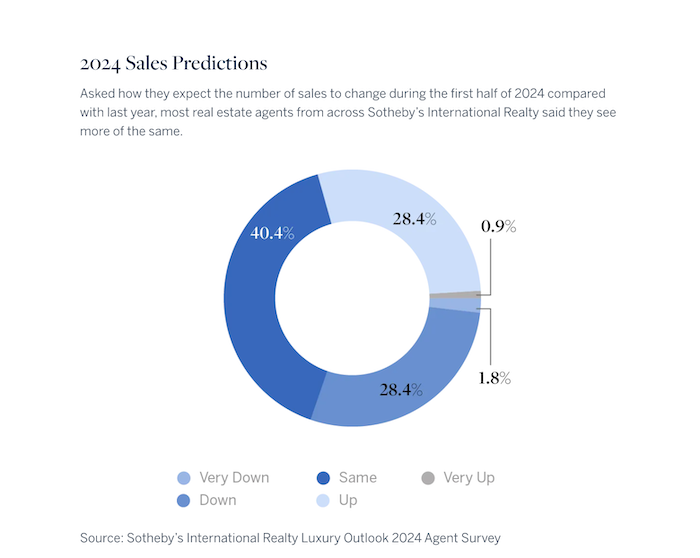

Recently, Sotheby’s International Realty out of our New York Headquarters released the 2024 Luxury Outlook. This is a comprehensive look at the luxury real estate market around the globe. It also looks beyond the real estate sector, to see what consumers of luxury goods desire, tech tools shaping the industry, record-breaking auction sales, and spotlights on the hottest areas for homeownership. This week, we are sharing Sotheby’s Luxury Outlook on emerging real estate hotspots.

While there will likely always be an enduring desire for people to own a pied-à-terre in Paris or a villa in Tuscany, the appeal and financial potential of global real estate markets shifts for a variety of reasons from one year to the next.

Property values change, new developments emerge, currencies fluctuate, and laws are adjusted, all of which affect investment opportunities. Markets that currently entice global investors and are poised for more growth include Australia, Mexico, Saudi Arabia, and Turkey, according to Sotheby’s International Realty insiders. Each offers a unique set of attractions for domestic and foreign real estate investors.

Australia’s Lifestyle Destinations Beckon

While ultra-high-net-worth investors from around the globe own property in Sydney and Melbourne, they often choose to buy a second home in one of the vacation destinations in Queensland, Australia, says Paul Arthur, CEO, Queensland Sotheby’s International Realty.

“We call them ‘lifestyle properties,’ and the state of Queensland has five or six of the best lifestyle locations in Australia,” Arthur says. Depending on the location, anywhere from 10% to 20% of the buyers are foreign, including Australian expats, with the rest domestic buyers, he says.

“Australia fared well during the pandemic and is considered a safe haven for buyers because of the stability of our economy and the Australian dollar,” Arthur says. “Queensland still offers an amazing value for luxury properties compared to many global markets. The change in workplace practices makes this location even more appealing because people can enjoy their lifestyle properties for longer periods of time.”

For international investors, Arthur points out the current opportunity to take advantage of better value because the Australian dollar is weak compared with the euro, the pound, and the American dollar.

“Property values almost doubled in the Gold Coast area of Queensland over the past three years,” Arthur says. “There’s a mix of single-family homes from A$800,000 to A$27 million, and high-rise condos from A$1.2 million to A$7 million. The Gold Coast is known for its pristine beaches, glitz and glamour, nightlife, and restaurants.”

Many of the condo buyers there are looking for canal-front properties with docks for boats and jet skis, Arthur says. “There’s plenty of new development on the Gold Coast, with about 15% to 20% of buyers from Asia, especially Singapore, Hong Kong, and China,” he says. “Noosa, which is north of Brisbane, has significant height and building restrictions, which makes it appealing for many buyers who like the flora and fauna, smaller buildings, and exclusivity.”

The Whitsundays region, which offers access to the Great Barrier Reef and has numerous islands and private islands, appeals to serious boaters, Arthur says. They mostly buy condos that start at A$1.2 million and up. Single-family homes on an island are priced up to A$20 million.

“For people looking for a tropical climate, Port Douglas has a wet and dry season, access to the Daintree rainforest and to the Great Barrier Reef,” Arthur says. “This is a lifestyle location that attracts a lot of Australians and Australian expats. The homes range from A$800,000 to A$12 million.”

Mexico City’s Resurgence Into a Cultural Beacon

Mexico City is one of the world’s top places for quality of life, says Laura de la Torre de Skipsey, real estate professional, Mexico Sotheby’s International Realty. The capital city, known for its spectacular art and archaeological museums, world-class shopping, exciting nightlife, and acclaimed restaurants, is a magnet for Americans and Canadians looking for a metropolitan lifestyle, de la Torre de Skipsey says.

“We’ve seen a big influx of remote workers from America and Canada who can buy a home here and experience an amazing quality of life,” she says. “American manufacturers are also coming to Mexico and bringing their executives here, plus we have expats from all over the world who want to enjoy the city and resort areas.”

In addition to Mexico City, de la Torre de Skipsey says Europeans and Americans are investing in property in Oaxaca, Escondido, Puerto Vallarta, and Riviera Maya.

“The key factors encouraging people to buy property here are the lifestyle and the culture, especially in the city,” she says. “Plus, Mexico is close to the U.S. and easy to get to. Europeans are especially drawn to the resort communities for second and third homes.”

For many years, all her clients were Mexicans, de la Torre de Skipsey says. “Now, more Americans and British families are buying single-family homes in the city in neighborhoods like Las Lomas because that’s where a lot of American, British, and French schools are located,” she says. “People looking for nightlife and the city lifestyle are drawn to Condesa and Roma, which are already expensive and well-known.”

The neighborhoods of Colonia and Polanca are also popular, especially the new Rubén Darío 225 tower, which has US$4 million to US$10 million apartments with room-sized terraces overlooking the city.

“Five years ago, our market wasn’t anything like this, but now North Americans and Europeans are recognizing the value they can get investing in Mexico, along with the culture,” de la Torre de Skipsey says. “This is only the beginning of the growth of the luxury market here.”

Saudi Arabia Poised for Progress

While luxury properties can be found in abundance in Saudi Arabia, only Saudis can buy and sell properties there, says Erick Knaider, managing partner, Saudi Arabia Sotheby’s International Realty.

“Technically, an expat or foreign investor can partner with someone in Saudi Arabia and follow an extremely strict set of rules to buy property,” Knaider says. “For example, they must use the property as their personal residence and can only own one property in the kingdom. But frankly, almost no one has done this.” But that is all about to change. “The final stages are in place to enact a law that will allow foreign investment in Saudi real estate, which will mean a drastic shift in demand,” Knaider says. “This law will be a huge turning point for luxury real estate here. It will be the final piece of the puzzle and encourage more development.”

Knaider says that Sotheby’s International Realty entered Saudi Arabia in early 2023 in anticipation of the game-changing rules. “For the past few decades, builders in the kingdom have looked into developing branded residences, which are extremely popular in Dubai, but most have waited because of the lack of foreign investors,” Knaider says. “Foreign investors are drawn to branded residences because of the sense of comfort and luxury associated with them. They know what to expect.”

In Saudi Arabia, very few branded residences have been built so far. Instead, luxury buyers typically purchase land and build a custom villa, he says. “There are some luxury condo developments, especially on the coast in Jeddah, such as Raffles, where there are very large units with at least 875 square meters that are priced from US$2.7 million and above,” Knaider says. “But they are only sold to Saudis so far. The only other examples of development like that are the Fairmont in Riyadh and the Four Seasons coming next door to Raffles.”

Knaider anticipates dramatic change when new regulations are enacted, which he expects could be within the year. “We need to build luxury residential communities with the amenities people want, such as a swimming pool, basketball courts, and a town center shopping area,” Knaider says. “Nothing like that exists yet, so we are optimistic that this represents an enormous opportunity for investors.”

Rich History, Culture Attract Global Buyers To Turkey

Turkey’s location as the crossroads for Asia, Europe, and the Middle East contributes to the country’s cosmopolitan appeal for a wide range of international buyers, says Can Turkan, CEO, Türkiye Sotheby’s International Realty.

“The 300% depreciation of the Turkish currency compared to the American dollar over the past three years has driven up tourism and demand for residential properties,” Turkan adds. “High-net-worth individuals from Russia and Ukraine continue to buy property here and, as usual, we have many buyers from Kuwait, Saudi Arabia, Qatar, the United Arab Emirates, and Lebanon who purchase homes in Turkey because they like that we are a Muslim country and a modern country.”

Foreign buyers who purchase US$400,000 worth of property in Turkey are eligible for Turkish citizenship, which Turkan says has attracted many wealthy people from Syria, Afghanistan, Iraq, and Iran who want stability.

“Another pool of buyers are high-net-worth individuals who just want a special luxury residence to enjoy full-time or for several weeks of vacation each year,” he says. “We also see European buyers, especially Turkish immigrants to Germany, who want to invest in Turkey.”

In Istanbul, international investors primarily focus on the European side of the Bosporus Strait, which is part of the continental divide between Europe and Asia and connects the Black Sea and the Sea of Marmara, because of the fine dining and luxury shopping opportunities there, while domestic luxury buyers focus on the Asian side, he says. The Asian side is quieter, which appeals to local Turks and Turkish expats, while the European side is more bustling. “While there are some branded residences in Istanbul, we are talking with developers and luxury auto and fashion brands to develop more of them,” Turkan says.

“High-net-worth buyers focus most on the 700 waterfront mansions on either side of the Bosporus, which sell for US$10 million up to US$300 million. No one can build along the Bosporus anymore, so these properties are like investing in gold and will only increase in value.”

Turkan anticipates that over the next two decades, development in Istanbul of all types will be concentrated to the north and west of the city from the Third Bosporus Bridge toward Istanbul International Airport, which could appeal to long-term investors.

Another concentration of wealth in Turkey is in the resort area of Bodrum on the Aegean in Southern Turkey, where branded residences such as the Mandarin Oriental, the Four Seasons, and the Ritz-Carlton are located.

“Bodrum is similar to the Côte d’Azur and the Greek islands,” Turkan says. “It attracts an international crowd including Americans who bring their yachts there. U.S. buyers are rare, but we see a few. We’re also seeing more Latin American luxury buyers from Colombia and Venezuela.”

Besides the opportunities in Istanbul and Bodrum, Turkan says there’s room for upscale residential development in Izmir, a resort city on the Aegean and the third-largest city in Turkey.

See more of the Luxury Outlook Report for 2024.

RELATED: 4 Living Rooms Perfect For Hosting An Award-Winning Viewing Party